COVID-19 Accelerates E-Commerce Surge, Sparking Investment in Industrial Real Estate

A little over two years ago, our hometown paper, The Columbus Dispatch, published an article about an emerging trend: the rapid growth in demand for industrial real estate in Central Ohio.

A little over two years ago, our hometown paper, The Columbus Dispatch, published an article about an emerging trend: the rapid growth in demand for industrial real estate in Central Ohio.

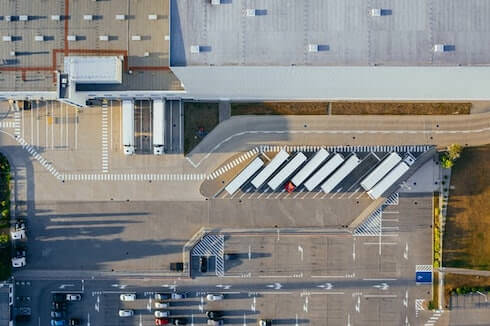

At the time, the article focused on the “Amazon effect” – the local warehousing of an enormous stockpile of products for regional distribution. With about 2 million square feet of industrial real estate in just two facilities, Amazon was king. But smaller businesses were about to be knighted, too, as online shopping continued to increase. Even then, the article noted that warehouse vacancy rates were trending downward to as little as 3 percent in the Grove City and West Jefferson markets.

In our wisdom – or maybe, “dumb luck” – our team at The Robert Weiler Company also forecasted a favorable climate for industrial real estate in an article on warehouse rental space. And, in addition to prognostications about the sector, we also offered insightful steps for finding, leasing, and optimizing new industrial real estate.

However, even with all the tarot cards and crystal balls, nobody could foresee the massive shift in the industrial real estate landscape due to a pandemic.

The Impact of COVID-19 on Warehouse Space

Fast-forward to today, and the novel coronavirus is having an additional impact. At the peak of the state-mandated shutdowns, millions of Americans turned to e-commerce solutions to purchase everything from clothing and electronics to sporting goods and groceries. According to the latest data from Signifyd, a leader in e-commerce fraud protection, buy online/in-store pickup increased by an incredible 248 percent at the end of May 2020, compared to before the pandemic. Meanwhile, overall online shopping is up about 40 percent at the beginning of June 2020, compared to early March 2020.

The psychology behind the digital retail surge is clear: Consumers fear the infection, but they still need to live. The conundrum requires the fast and efficient purchase of goods at reasonable prices. Granted, online shopping has always been a conveyor of convenience; now, that convenience has become a necessity. As a result, it will likely become a new way of life that consumers will be reluctant to give up.

The e-commerce cat is, once and for all, out of the bag. The question is: Will brick-and-mortars retailers and the industrial real estate sector keep pace?

A Shift in Shopping is a Boom for Business

So far, the early answer to the question above is “yes.” With mom-and-pop brick-and-mortar retailers reeling from the virus, only the most creative will survive.

The reduction in foot traffic and a possible exodus of people from major cities to nearby suburban and rural communities mean that businesses will shift their “immediate-need” inventory practices into more of a surplus stockpile model. Instead of purchasing what’s needed for a short period to be sold on store shelves, products will be bought in larger quantity and bulk, presumably at better prices. Ultimately, those products will be stored in a small warehouse space or perhaps a large warehouse facility near the existing (or former) brick-and-mortar location.

The scenario is especially advantageous for Central Ohio and Columbus, Ohio at large. Thanks to its Midwest location, Columbus is a natural distribution point by both land (I-70 and I-71) and air. Many major American cities are within that critical 600-mile radius, where it’s often faster to drive than fly. Such cities include Atlanta, Raleigh, Nashville, Washington, DC, New York, and many more.

Within the broad contours of the warehouse rentals boom, refrigerator and freezer space likely show the most significant room for growth as online grocery shopping has taken off. Before the coronavirus, many shoppers deemed such services as expensive, extravagant, and generally unnecessary. After all, grocery shopping can be an enjoyable community activity and even a time to socialize.

That is no longer the case.

Now, the convenience of having groceries delivered to your door seems like a great idea. Already, according to U.S.-Israeli warehouse automation provider Get Fabric Ltd, more than half of U.S. shoppers have bought groceries online. What’s more, commercial real estate firm CBRE Group Inc. finds that 75 million to 100 million square feet of industrial freezer and cooler space will be needed to keep pace with this new demand. And businesses aren’t only searching for industrial space for rent, but also industrial space for sale.

Greater Columbus will not be the sole region to benefit from increased investment in warehouse space. Another cause for warehouse space growth comes down to supply chain challenges. Just as the electricity grid benefits from distributed power, allowing for better redundancy should any one power plant fail, distributed warehousing means that goods can be stored in multiple locations throughout the country. The idea of distributed warehousing is keeping storage closer to existing or newfound manufacturing plants.

Not only are large warehouse spaces benefiting from the boom, but small warehouse spaces are, too. Small industrial spaces (meaning spaces under 70,000 square feet) have the lowest average availability (5.8 percent) and the highest average rents of $8.01 per square foot.

While costly from a square footage perspective, small warehouse space could be the right fit for go-getters with some start-up capital to spare and a surplus of products to store. Combined with the right online marketing strategy and they, too, could be one of the lucky ones to emerge from the coronavirus pandemic relatively unscathed.

The Clearinghouse for Your Warehouse Purchase Needs

Two years before COVID-19 and novel coronavirus entered our collective lexicon, The Columbus Dispatch (and The Robert Weiler Company team) alluded to the rapid growth in demand for warehouse space in Columbus, Ohio and Central Ohio. Both of us predicated the proposed growth on an uptick in online sales and the value of distributed storage.

How prophetic are we?

And, even as Americans adjust, likely, many of the current consumer habits that developed in the last few months will persist.

In light of that trend, researching industrial real estate in Columbus, Ohio is an opportune way to diversify your commercial property portfolio. The Robert Weiler Company is a full-service commercial real estate and appraisal firm committed to understanding your unique needs. We are keen on getting you what you want. Our 80+ years in the business give us a competitive advantage in the market – a value you won’t find from any other firm specializing in commercial real estate in Columbus, Ohio, or beyond.

Whether you need help with buying or selling a warehouse property or simply want to uncover the market value of your industrial real estate with an appraisal, our team can help. Get in touch with The Robert Weiler Company and let us provide our warehouse space and industrial real estate expertise. We’re here to serve you; get in touch at 614-221-4286.